Table of Contents

Introduction

For the last few years, we have published a series of “Hardware Trend” articles looking at our overall sales trends for various categories. The exact way we have compiled and compared the data has shifted a bit over the years, but today we want to continue this series and look at how our CPU, GPU, OS, and Storage sales have changed between 2021 and the end of 2023. If you want to check out the old articles, they are available here: “Hardware Trends of 2021” and “Puget Systems Hardware Trends of 2022“

In many ways, 2023 was a continuation of what we saw in 2022, although it is very interesting to see how our predictions compared to reality. However, there were a few curveballs thrown our way – such as the re-introduction of AMD’s Threadripper platform – which, as you would expect, changed some of our sales numbers by quite a bit. Overall, in 2023 (and at the tail-end of 2022), we had the following hardware launches:

- NVIDIA RTX 6000 Ada (Q4 2022)

- Intel Core i9 13900KS (Q1 2023)

- NVIDIA RTX 4070 Ti (Q1 2023)

- Intel Xeon W-2400/3400 (Q2 2023)

- AMD Ryzen 7900X3D/7950X3D (Q2 2023)

- NVIDIA RTX 4060 Ti & 4070 (Q2 2023)

- NVIDIA RTX 5000/4500/4000 Ada (Q3 2023)

- Intel Core 14th Gen (Q4 2023)

- AMD Threadripper 7000 (Q4 2023)

- AMD Threadripper PRO 7000WX (Q4 2023)

That is a LOT of product releases in a relatively short period, but most were straight-forward generational improvements that didn’t have a major impact on what type of hardware works best for various workflows. Only the Threadripper and Threadripper PRO launches at the end of 2023 changed things drastically, and even there it was more a splitting of AMD workstation CPUs into two separate lines rather than changing the overall AMD vs Intel dynamic.

Before we start looking at exact numbers, we want to clarify that this data represents our workstation sales at Puget Systems and is not indicative of the computer industry at large. We focus on high-end workflows for content creation, engineering, and scientific computing, often with very different priorities than gaming or general home/office systems. We are also constantly growing and evolving as a company, targeting different industries and workflows as time passes. This can, at times, result in changes to our sales stats more than any work AMD/Intel/NVIDIA is doing directly on their product lines. With that in mind, let’s jump into the data!

CPU (Processor)

Starting off with the CPU, we decided to divide the data into two groups: “Client” processors (including AMD Ryzen and Intel Core), and “Workstation” processors (AMD Threadripper/Threadripper PRO and Intel Xeon). The term “Client” is a bit of a misnomer these days, as Ryzen and Core CPUs are commonly used in workstations, but we wanted to separate out these classes of processors since they have very different capabilities and price points.

Client CPU sales are very interesting to look at over the last few years, because AMD Ryzen used to hold the majority of CPU sales in this segment. However, at the end of 2021, Intel released the Intel Core 12th Gen processor family, which, as we showed in our review at the time, catapulted Intel in front of AMD for a wide variety of the workflows we target. This resulted in a flip of Intel and AMD sales in our workstations, and Intel has continued to grow their market share with the Core 13th Gen and 14th Gen processor families.

We still build a good number of AMD Ryzen systems, but all told, we ended 2023 with Intel Core consisting of about 80% of our “Client” CPU system orders. However, we are very interested to see if this changes when AMD’s next Ryzen processors launch (presumably) later this year!

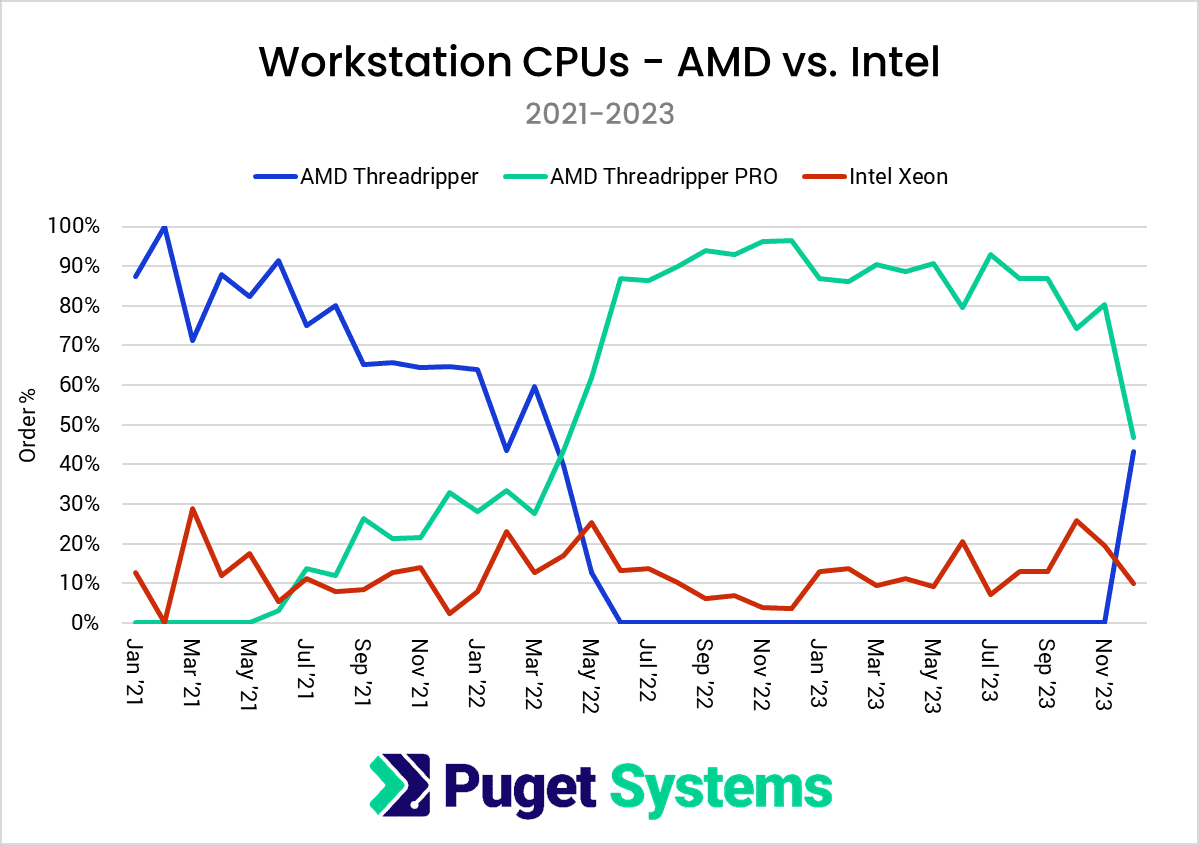

While Intel has had a firm lead for client CPUs in our systems over the last few years, AMD has had an even stronger lead for workstation processors.

As you can see in the chart above, our sales of AMD CPUs over the last few years have been interesting since they dropped the Threadripper line in mid-2021; focusing their “5000” series on Threadripper PRO exclusively. It took a while for our sales to catch up since Threadripper PRO 5000WX introduced a price increase over the Threadripper 3000 line, but by June of 2022, we were no longer selling any Threadripper CPUs – having moved entirely over to Threadripper PRO.

However, with the 7000 series at the end of 2023, AMD brought back the Threadripper line, alongside Threadripper PRO. We have a whole AMD Ryzen Threadripper 7000 vs Threadripper PRO 7000WX for Content Creation article comparing these two product lines if you are interested. Motherboard supply shortages prevented us from selling many of these new CPUs until December of 2023, but so far (including Jan/Feb 2024, which are not shown in the chart above), our AMD workstation CPU sales have been almost perfectly split between Threadripper 7000 and Threadripper PRO 7000WX.

Interestingly, even with the Threadripper launches, Intel actually had a slight comeback in 2023 compared to 2022. At the end of 2022, AMD has a massive 95% market share in our systems for this segment, but by the end of 2023, this has dropped slightly to 90%. That is still very much in AMD’s favor, and likely only partially due to the launch of Intel’s W-2400 and W-3400 processors in Q2 of 2023. More likely, this is a symptom of an increase in the number of our customers looking for HPC and Scientific Computing systems that benefit from some of the technologies found on Intel Xeon processors.

Overall, just like in 2022, we ended 2023 with nearly an equal split between Intel and AMD CPUs in our workstations across both the Client and Workstation space. For Intel, almost all of our sales were for the Core processors. However, for AMD, Threadripper and Threadripper PRO now account for a much larger percentage of our AMD processor sales compared to Ryzen, whereas in 2022, Threadripper and Ryzen were almost evenly split.

GPU (Video Card)

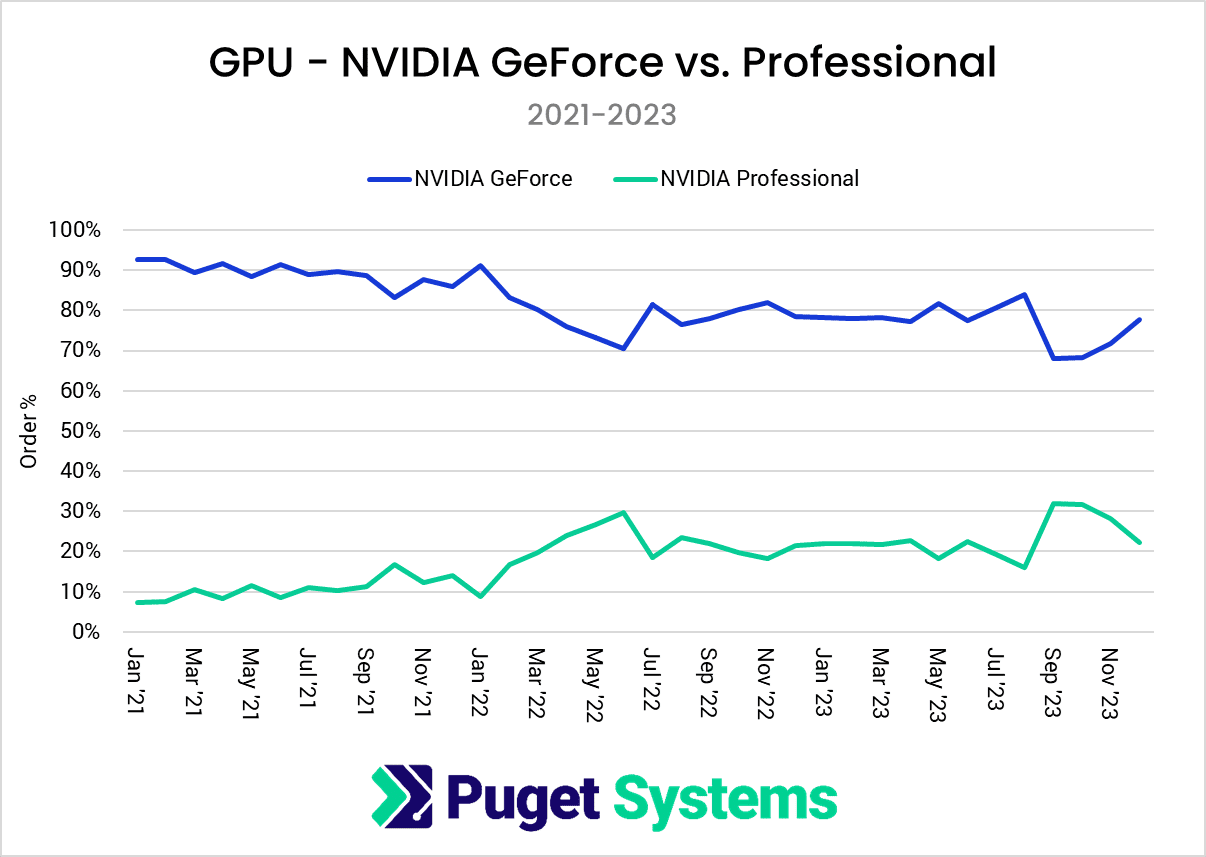

Because we focus so heavily on content creation, engineering, and scientific computing workflows, we use NVIDIA GPUs almost exclusively in our workstations. That is something we hope changes in the future since competition is always better for the consumer, but for now, NVIDIA has the advantage of the majority of workflows we target.

What we can do, however, is look at how our GPU sales break down between NVIDIA’s consumer-oriented GeForce line and their Professional (NVIDIA RTX, formerly Quadro) line.

Overall, 2023 was mostly about the same as the end of 2022, with the GeForce GPUs being about 80% of our overall GPU sales for the year. This shifted a bit at the end of 2023 with the launch of the newer “Ada” series of cards, with Pro GPUs accounting for about 30% of our GPU sales in September and October. In addition to the NVIDIA RTX Ada line, we have also seen a general increase in requests for AI and Machine Learning workstations, which often benefit from larger VRAM capacities found on GPUs like the RTX A6000 and 6000 Ada.

We don’t expect GeForce and RTX cards to have parity in our workstations any time soon, but it is interesting to see the slow shift over time. Whether this trend continues, however, is very hard to predict, and likely will have more to do with the industries we are selling systems into (AI/ML, virtual production, etc.) than anything NVIDIA is changing on the products themselves.

Storage

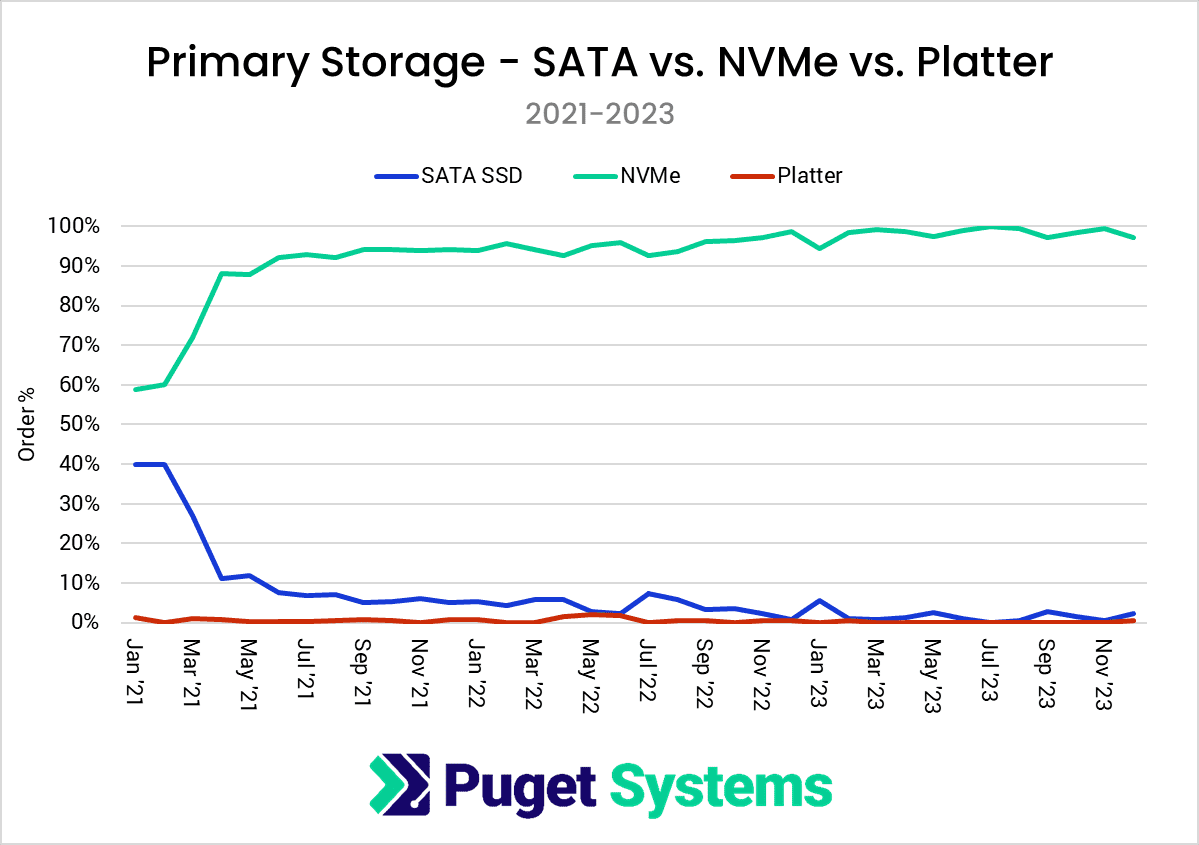

For storage, we are mainly interested in how our usage of NVMe, SATA SSD, and platter drives changed in 2023. However, because many of our systems ship with just one drive while others have two, three, or more drives, things get very messy quickly. So, to start, we are going to limit the data to just the primary drive, then look at the data across all the drives we have sold in our systems.

Overall, we have been very stable over the last few years regarding what type of drive we use for the primary OS drive in our systems. 2021 saw some big changes due to the availability of more cost-effective NVMe drives, but by the start of 2022, we were already using NVMe drives as the primary drive in 95% of our systems. Since then, NVMe drives have grown to account for nearly all our primary drives. It is only a handful of specialty accounts that specifically need SATA for one reason or another that keep this from being 100%.

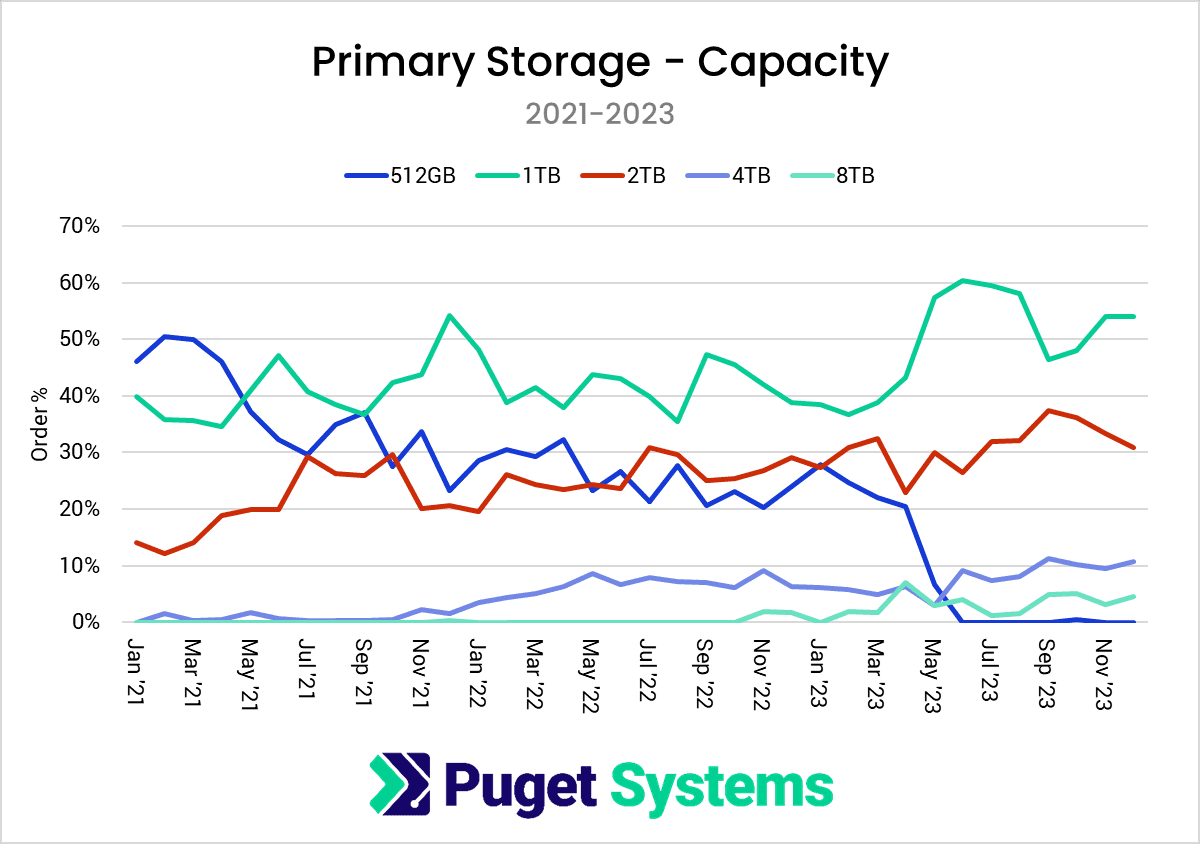

While the fact that we are almost exclusively using NVMe-based drives as the primary option in our systems hasn’t changed much in the last few years, what has changed is how large the drives tend to be. In general, as the cost of NVMe drives has fallen, we have been using larger drives more and more often. In addition, we made the choice in May of 2023 to completely discontinue the use of 512GB drives as a primary OS drive since they often were very tight for end users, and the cost difference between 512GB and 1TB became relatively minor.

Beyond a general upward trend in capacity, the only thing to note is that 2023 was when we really started using 8TB NVMe drives. They are still primarily used as secondary storage drives, but we ended 2023 with about 5% of our systems using one of these drives as their primary drive.

Switching to overall drive usage, NVMe drives are still the dominant option, but SATA SSD and platter drives are managing to hang on. We ended 2023 with SATA SSD only making up about 10% of our total drive sales, and platter drives making up about 5%. Most likely, these numbers won’t change much in 2024, and in fact, may see a bit of a resurgence with our relatively new rackmount storage solutions.

OS (Operating System)

While not hardware, we also wanted to include the OS in this post, as the move from Windows 10 to Windows 11 continues to be very interesting.

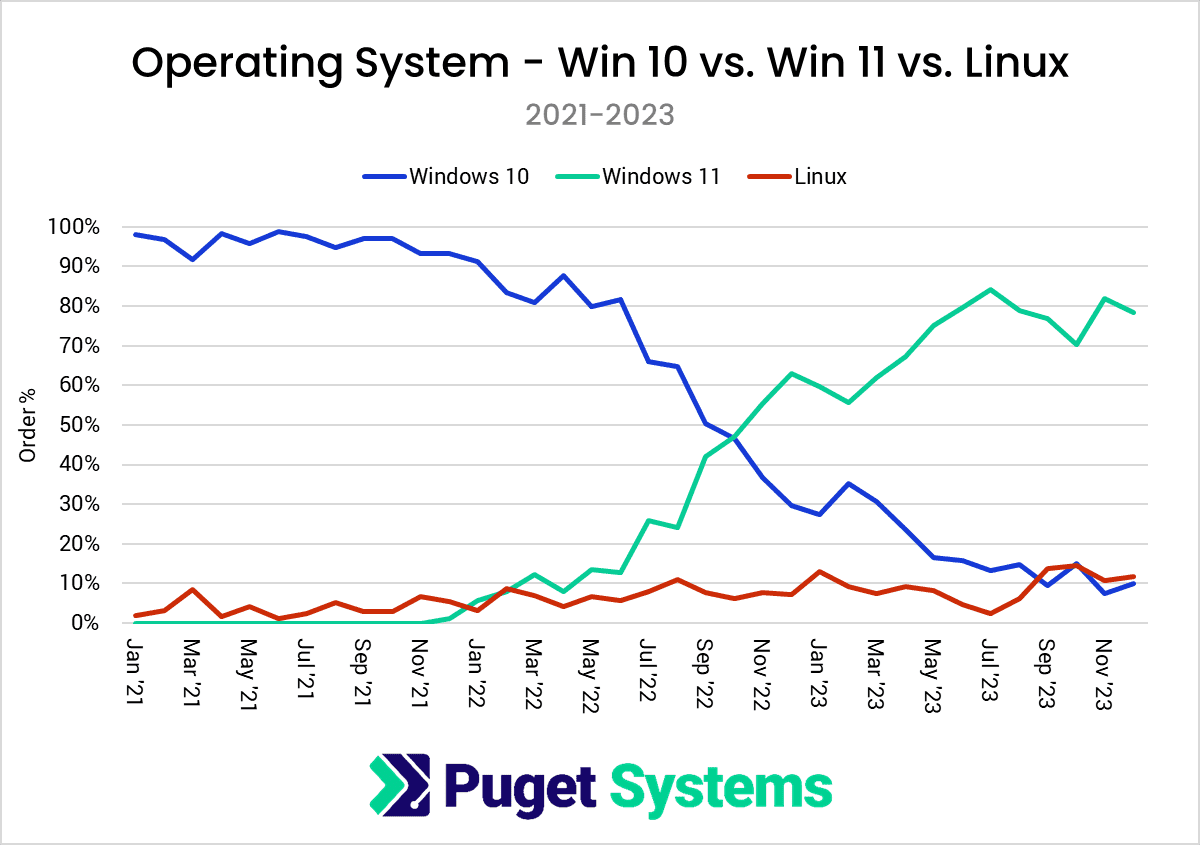

When Windows 11 launched at the end of 2021, there were significant issues with application compatibility. Some applications simply didn’t work, while others saw performance degradation on the newer operating system. It wasn’t until the end of July 2022 that support was good enough that we were comfortable making Windows 11 the default option on most of our systems, which was nearly 9 months after its official launch.

You can clearly see these milestones on the chart above. Slow adoption of Windows 11 at first, with a sharp increase around July 2022 as we became confident in the OS for the workflows we target. Even then, however, it wasn’t until October 2022 that Windows 11 passed Windows 10 as the most common OS used on our systems.

Since then, Windows 11 use has grown and currently is used on about 80% of the systems we ship. Still, about 10% of our systems opt to downgrade from Windows 11 to Windows 10 (since you can no longer buy a Windows 10 license directly), which shows that there are plenty of people out there who prefer Windows 10 over Windows 11 for whatever reason. To put that into perspective, we sell about as many Windows 10 systems as Linux – although the use cases for those systems tend to be drastically different.

Conclusion

Overall, 2023 didn’t have too many big shake-ups, but was still a very interesting year for us here at Puget Systems. However, many things happened at the end of 2023 (including the launch of AMD’s Threadripper 7000 and Threadripper PRO 7000WX processors), that make us very curious to see how our hardware trends may shift in 2024.

To summarize some of the bigger trends:

- Intel continues to have a lock in the client CPU space for us, with Intel Core out-selling AMD Ryzen by 4:1. However, AMD has a massive lead in the workstation space, with AMD Threadripper and Threadripper PRO outpacing Intel Xeon by nearly 10:1.

- GPU and storage sales were fairly consistent: market share for the NVIDIA RTX cards increased a bit relative to GeForce, and NVMe drives continue to dominate for storage.

- Lastly, Windows 11 is by far the most common OS used in our systems, but a 10% minority are still opting to downgrade to Windows 10.

The question now is how 2024 is going to shape up. New CPUs from AMD and Intel are always on the horizon, as well as new GPUs from NVIDIA, AMD, and Intel. In addition, we are expanding our product line in the server and storage spaces, and are even getting back into laptops! All of these factors could change what we see in our sales numbers, not to mention the growth we have been seeing recently in certain segments like AI, Machine Learning, Virtual Production, and many others.